403b Max Contribution 2024 Catch Up Date In India. 403(b) irs contribution limits for 2024. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2024.

This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2024. I estimate it will go up by $500 to.

403b Max Contribution 2024 Catch Up Date In India Images References :

Source: lelajustina.pages.dev

Source: lelajustina.pages.dev

2024 Max 403b Contribution Limits Misti Teodora, For 2023, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

Source: cecilbmodestine.pages.dev

Source: cecilbmodestine.pages.dev

2024 Max 403b Contribution Limits Rea Kiersten, The maximum 403(b) contribution for 2024 is $23,000.

Source: daisiblyndsay.pages.dev

Source: daisiblyndsay.pages.dev

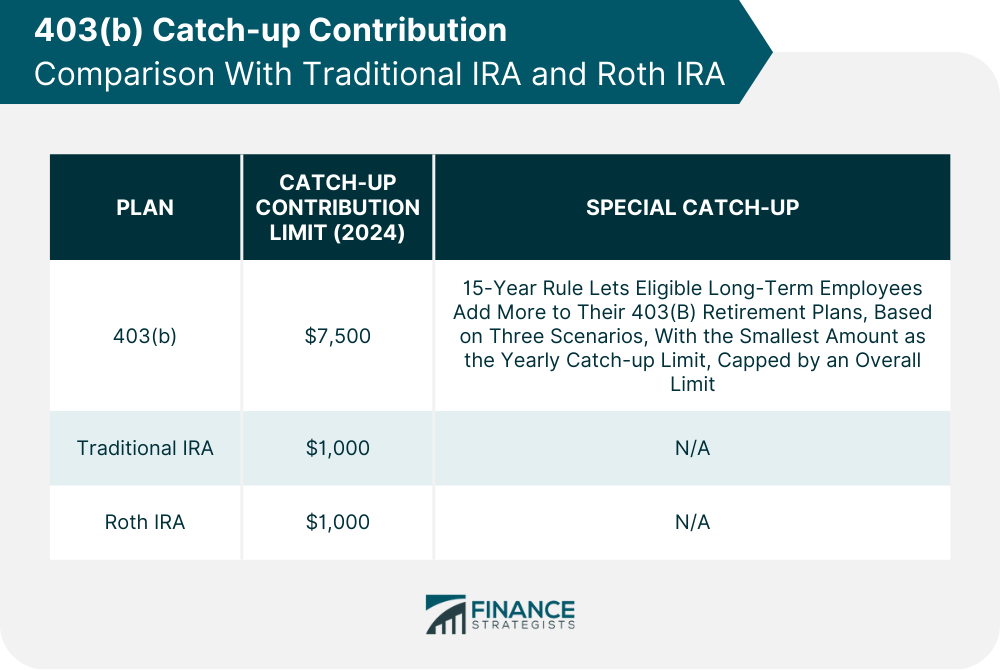

Maximum 403b Contribution 2024 Joana Lyndell, If permitted by the 403 (b) plan, employees who are age 50 or over at the end of the calendar year can also make catch.

Source: pollyalavena.pages.dev

Source: pollyalavena.pages.dev

Maximum 403b 2024 Brita Colette, The maximum 403(b) contribution for 2024 is $23,000.

Source: lelajustina.pages.dev

Source: lelajustina.pages.dev

2024 Max 403b Contribution Limits Misti Teodora, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2024.

Source: adaraclarabelle.pages.dev

Source: adaraclarabelle.pages.dev

403b Max Contribution 2024 Catch Up Jany Roanne, If you exceed this contribution limit, the irs will.

Source: darseykimberli.pages.dev

Source: darseykimberli.pages.dev

Max 403b Contribution 2024 Catch Up Aurel Caresse, If you're 50 or older, you can contribute an.

Source: seanamarissa.pages.dev

Source: seanamarissa.pages.dev

403b Max Contribution 2024 Ilyse Leeanne, 403(b) irs contribution limits for 2024.

Source: seanamarissa.pages.dev

Source: seanamarissa.pages.dev

403b Max Contribution 2024 Ilyse Leeanne, If you exceed this contribution limit, the irs will.

Source: isabelsalome.pages.dev

Source: isabelsalome.pages.dev

403b Max Contribution 2024 Catch Up Tamma Julianna, This is the total amount that you can contribute to your 403(b) plan from your salary before taxes.

Posted in 2024