Irs Direct Deposit Ctc 2024

The refundable portion of the child tax credit (ctc) for tax year 2023 (filed in 2024) is capped at $1,600 per. Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and irs and.

Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025. The irs urges any family receiving checks to consider switching to the speed and convenience of direct deposit.

For Youngsters Under Six, The Irs Will Start To Payout A $300 Direct Deposit On The 15Th Of Every Month Starting, If Approved By The.

A $300 direct deposit payment has been made by the internal revenue service (irs) in april 2024 to assist families across the united states.

Families Will Receive Their July 15 Payment By Direct Deposit In The Bank Account Currently On File With The Irs.

The irs $300 direct deposit stimulus is a program to be launched in 2024 under the child tax credit (ctc) to provide financial support to families with children.

Images References :

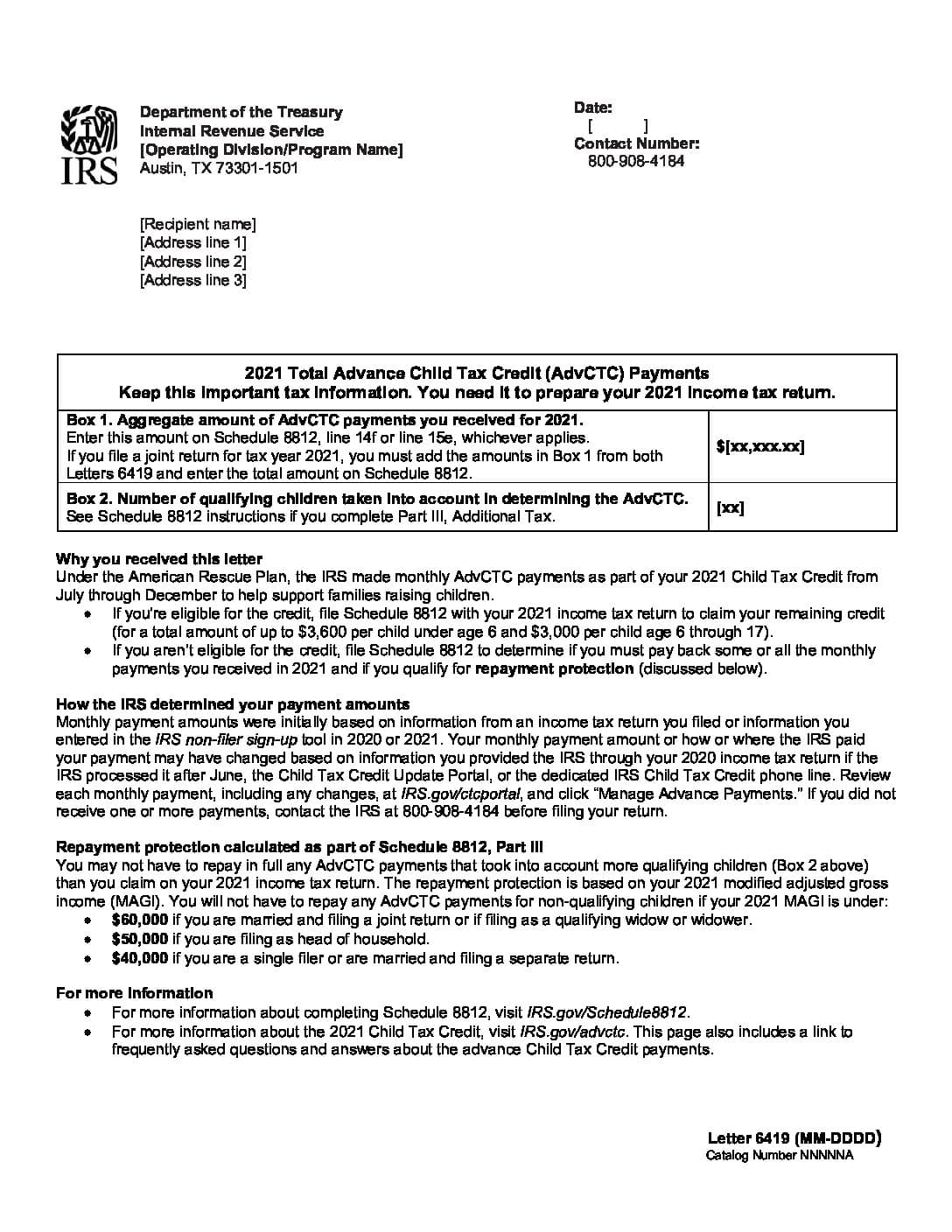

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Ctc For 2024 Irs Reyna Clemmie, You have a child under 17 at the end of 2023. The $300 direct deposit payment date 2024 has been stated as the 15th date of every month and the irs sends the direct deposit payment to the bank account.

Source: margaretewalicia.pages.dev

Source: margaretewalicia.pages.dev

Irs Direct Deposit Form 2024 Pat Celestia, June 9, 2024 by editorial board. Choosing direct deposit sends your refund straight to your bank account, bypassing the mail system and its delays.

Source: inbriefeducation.blogspot.com

Source: inbriefeducation.blogspot.com

IRS Direct Deposit 2024 Estimated date to get the refund for tax year, Families will receive their july 15 payment by direct deposit in the bank account currently on file with the irs. Ctc payment dates 2024 the.

Source: maryrosewiris.pages.dev

Source: maryrosewiris.pages.dev

Irs Deposit Schedule 2024 Chart Corie Donelle, You have a child under 17 at the end of 2023. Choosing direct deposit sends your refund straight to your bank account, bypassing the mail system and its delays.

Source: miofmelawchicky.pages.dev

Source: miofmelawchicky.pages.dev

Irs 2024 Direct Deposit Refund Schedule 2024 roana margaret, C payment dates 2024 for ctc the $300 direct deposit ctc 2024 would assist residents with children under the age of six with a payment of $300 and those with children ages. The irs $300 direct deposit stimulus is a program to be launched in 2024 under the child tax credit (ctc) to provide financial support to families with children.

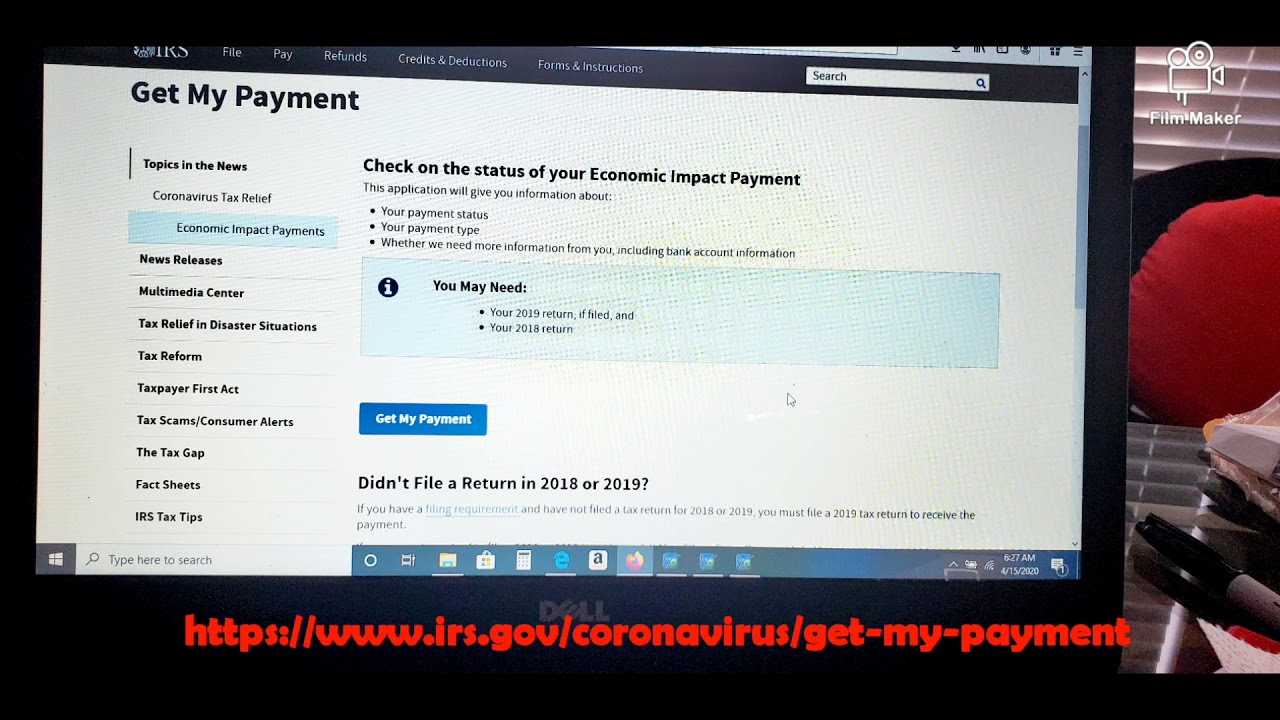

Source: www.youtube.com

Source: www.youtube.com

IRS Direct Deposit Stimulus Payment Website YouTube, The $300 direct deposit ctc 2024 would assist residents with children under the age of six with a payment of $300 and those with children ages six to seventeen with. Claiming both ctc and actc:.

Source: elenorewbertha.pages.dev

Source: elenorewbertha.pages.dev

Irs Tax Return Deposit Schedule 2024 Cordy Dominga, In 2024 the irs is expected to make a $300 direct deposit payout on the 15th of each month to those who are under 6 and those who aged 6 to 17 will expect to. Families can visit the child tax credit update portal to see if they’re receiving a direct deposit or paper check this month.

Source: corinaqothilia.pages.dev

Source: corinaqothilia.pages.dev

Irs Direct Deposit Dates 2024 Adrea Katharyn, The irs urges any family receiving checks to consider switching to the speed and convenience of direct deposit. What else would change with the.

Source: tax.modifiyegaraj.com

Source: tax.modifiyegaraj.com

Can You Update Direct Deposit With Irs TAX, The $300 direct deposit ctc 2024 would assist residents with children under the age of six with a payment of $300 and those with children ages six to seventeen with. Families can visit the child tax credit update portal to see if they’re receiving a direct deposit or paper check this month.

Source: tax.modifiyegaraj.com

Source: tax.modifiyegaraj.com

How To Change The Irs Direct Deposit TAX, Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and treasury and. The irs urges any family receiving checks to consider switching to direct deposit.

With Direct Deposit, Families Can Access Their Money More Quickly.

With direct deposit, families can access their money.

The $300 Direct Deposit Payment Date Is On The 15Th Day Of Every Month In 2024.

The irs urges any family receiving checks to consider switching to the speed and convenience of direct deposit.

Category: 2024