When Is The First Quarter Of 2024 941 Due. Due date for the deposit of tax deducted/collected by an office of the government for march 2024. Employers are advised to start using the march 2024 revision of form 941 beginning with the first quarter of 2024.

The due date for the deposit of tax deducted/collected by an office of the government for march 2024. Form 941 is due by the final day of the month after a quarter ends:

The Deadline To File 941 Will Be The Last Day Of The Month Following The.

Organizations have until january 31 to submit this form, so the due date for reporting 2023 unemployment taxes, is january 31, 2024.

Most Businesses Must Report And File Tax Returns Quarterly Using The Irs Form 941.

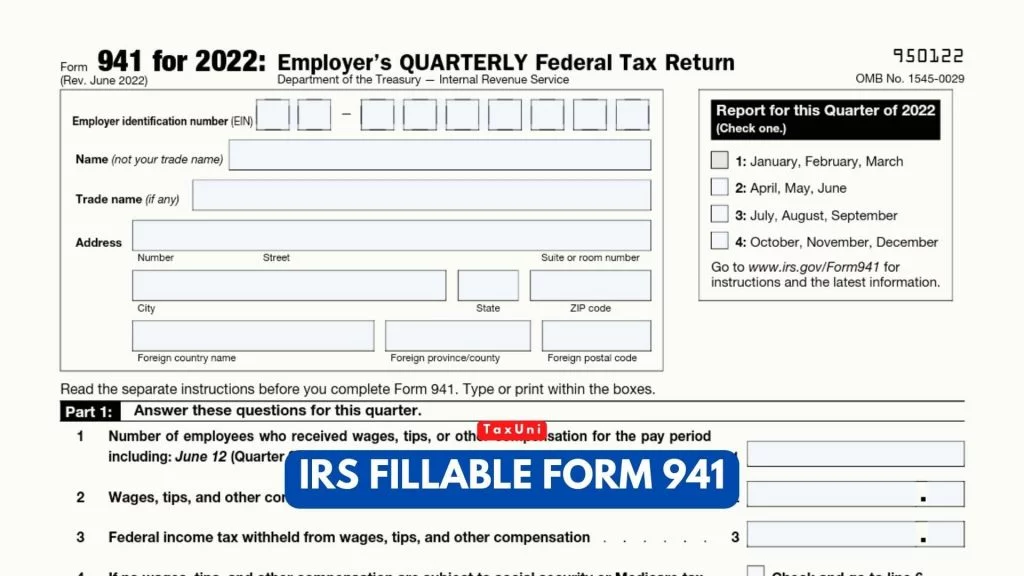

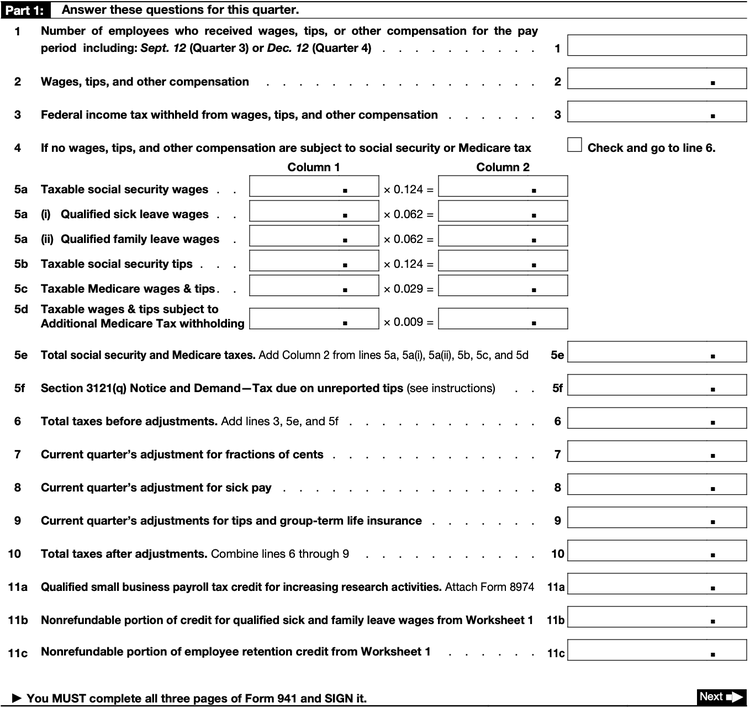

File form 941, “employer’s quarterly federal tax return,” to report medicare, social security and income taxes withheld in the fourth quarter of 2023.

Employers Report Income Tax Withholding.

Images References :

Source: robbyqcarmelia.pages.dev

Source: robbyqcarmelia.pages.dev

When Is Form 941 Due 2024 Ibby Theadora, This is the due date for the deposit of tax deducted/collected. Final versions of the quarterly federal.

Source: www.dochub.com

Source: www.dochub.com

941 irs Fill out & sign online DocHub, Qualified small business payroll tax credit for increasing research activities. File form 941, “employer’s quarterly federal tax return,” to report medicare, social security and income taxes withheld in the fourth quarter of 2023.

Source: robbyqcarmelia.pages.dev

Source: robbyqcarmelia.pages.dev

When Is Form 941 Due 2024 Ibby Theadora, This is the due date for the deposit of tax deducted/collected. One should also be aware that the social security wage base limit.

Source: www.youtube.com

Source: www.youtube.com

IRS Form 941 for First quarter is due on May 1,2023! YouTube, Here's a look at the tax calendar for april 2024 as per the income tax department: The revision is planned to be used for all four quarters.

Source: www.youtube.com

Source: www.youtube.com

Form 941 Changes For The First Quarter of 2023 (Revised Form 941) YouTube, For tax years beginning before january 1, 2023, a qualified small business may elect to. Employers should use the march 2024 revision beginning with the first quarter of 2024.

Source: www.fool.com

Source: www.fool.com

How to Prepare and File IRS Forms 940 and 941, Employers should use the march 2024 revision beginning with the first quarter of 2024. However, all sums deducted by an office of the.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Form 941 Excel Template, Most businesses must report and file tax returns quarterly using the irs form 941. Form 941 is due by the final day of the month after a quarter ends:

Source: nicolettezbrooks.pages.dev

Source: nicolettezbrooks.pages.dev

Irs Form 941 Schedule B 2024 Kore Shaine, Due date for the deposit of tax deducted/collected by an office of the government for march 2024. Keep your federal tax planning strategy on track with key irs filing dates.

Source: www.deskera.com

Source: www.deskera.com

What is the IRS Form 941?, Employers report income tax withholding. The deadline to file 941 will be the last day of the month following the.

Source: www.dochub.com

Source: www.dochub.com

941 irs Fill out & sign online DocHub, Qualified small business payroll tax credit for increasing research activities. File form 941, “employer’s quarterly federal tax return,” to report medicare, social security, and income taxes withheld in the fourth quarter of 2023.

However, All Sums Deducted By An Office Of The.

Here's a look at the tax calendar for april 2024 as per the income tax department:

Form 941 Is Used By Organizations That Wish To File Their Payroll And Income Tax Returns Quarterly.

Qualified small business payroll tax credit for increasing research activities.